The new margin expected is generally a small % (about step three% to a dozen%) of your own offer’s full worth, or notional worth, and you will varies depending on the asset’s volatility. Futures margin is different from inventory margin, because it’s perhaps not borrowed money, but alternatively a great ‘good-believe deposit’. The time always initiate early having a peek at right away field pastime, a of your economic schedule to have secret analysis launches, and you may a diagnosis of every market-moving development. They’re also consistently conducting comprehensive market research, looking at macroeconomic style, evaluating geopolitical situations, and you can getting at the top of market-certain reports that may change the segments they trading.

By the stepping into it package, in one season the producer is actually compelled to deliver one million barrels from petroleum which can be certain to receive $78 million. The newest $78 rate per barrel are gotten irrespective of where put field rates has reached the time. Even though futures agreements try dependent to your another time section, their main purpose is always to mitigate the risk of default from the either team in the intervening period.

Best forex for beginners – Underlying asset categories from futures contracts

- The fresh conclusion date happens when a good futures deal technically finishes, and each party need settle the newest trading.

- Like with almost all types, futures buyers produces currency when advantage cost increase otherwise slip.

- Including, if you would like exchange a crude oils futures offer having an excellent notional property value $fifty,100000, you could only need to deposit $5,100 since the margin.

- Let’s discuss specific crowd-favorites you to definitely’ll maybe you have impression such a seasoned expert very quickly.

- When paired with rate and you will frequency study, it can help verify the effectiveness of a pattern.

Like all futures deals, commodity futures are often used to hedge or manage an investment reputation or even bet on the brand new directional direction of your underlying investment. Because they wear’t compensate really futures buyers, of several protections in the market guard against investors profiteering or ultimately causing volatility that would connect with informal people or other marketplaces. Such, speculation inside futures areas to own agricultural products including grain, corn, and soybeans could have been linked to extreme rate shifts.

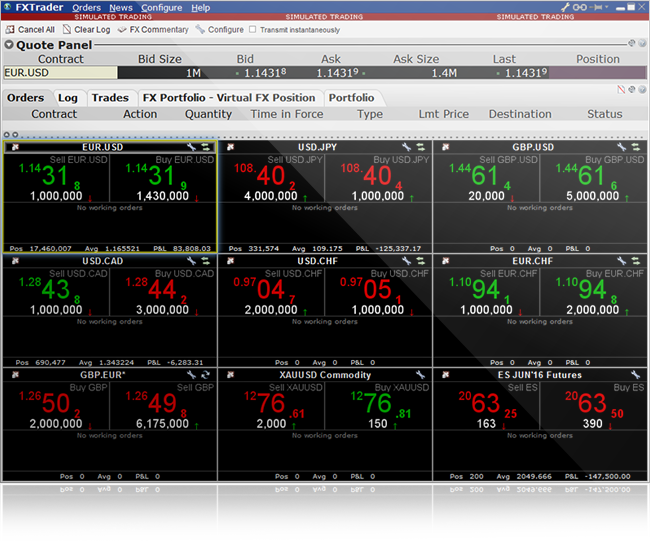

As its label means, a great futures package are a monetary tool by which a purchaser and you may supplier commit to transact an best forex for beginners asset during the a fixed rate in the the next time. Although some futures agreements have highest lowest offer models, particular transfers such CME Group has produced lower deals to attract personal, or private, futures change. The most popular E-mini contracts depend on stock indicator, like the S&P five hundred, Nasdaq 100, and you may Dow-jones Industrial Average.

Key Futures Contracts because of the Advantage Category

Managing margin conditions and keeping a healthy collection are also vital regions of this action. Hedgers usually were suppliers and you will users of a product and/or holder from a valuable asset or property subject to certain has an effect on such as while the mortgage. For example, inside old-fashioned product locations, producers often promote futures contracts to the plants and you can livestock it create to ensure a specific speed, making it easier to allow them to package. Likewise, animals makers tend to get futures to pay for their offer costs, so they can anticipate a fixed costs to have provide.

Should the individual assume correctly as well as the resource well worth slide, they can benefit by buying the fresh bargain right back during the an excellent smaller rates. The fresh column for the remaining shows the newest day when per offer stems from end, when you are information regarding rates (in addition to rates change) and you will quantities can also be seen. You should know you to NFA does not have regulating oversight authority more hidden otherwise put digital currency items otherwise deals otherwise virtual money transfers, custodians otherwise places. That’s as to why 150,000+ investors connect to the Dissension so you can exchange information, express victories, and be driven. Dive to the #group-lessons channel to get in touch with this teachers, get your inquiries answered alive, and you can level up your change instantly.Futures offer the equipment. A great prop business will give you the fresh backing.During the Topstep, we’re not simply right here to watch you trade.

Technology research is actually an option tool inside the futures trading, assisting you to predict price motions according to historic investigation. It’s for example are a detective, examining clues from the prior to solve coming industry secrets. Just after a position are opened, in case your account really worth falls underneath the needed margin on account of losings, a futures margin call may be awarded. Investors will meet futures margin calls adding finance otherwise cutting the ranking to prevent pressed liquidation.

What is A great Futures Package?

The problem the spot where the price of an item to own future beginning exceeds the fresh requested place price is labeled as contango. Locations have been shown getting normal when futures prices are above the present day place speed and much-old futures are cost more than near-dated futures. The reverse, in which the price of a product to have upcoming delivery is lower than the asked place price is known as backwardation. Also, places have been shown to be upside-down whenever futures costs are lower than the present day put rates and much-old futures is listed below close-old futures. For the expiration time, a great European guarantee arbitrage trading table inside London or Frankfurt have a tendency to see ranking end inside possibly eight major places the approximate half-hour.

What are the results In the event the People Hold a Futures Deal Up to Expiration?

If you’ve been committing to carries, possibilities, otherwise crypto, you’ve most likely been aware of Futures Exchange. Futures is standard contracts with a preset date and you will price one obligate the buyer to buy or the supplier to offer an enthusiastic asset, for example stocks, petroleum, otherwise cryptocurrency. Fundamentally, it’s an excellent directional wager with high control than trade brings by yourself.

Which financing method is generally suitable for knowledgeable buyers but can getting too volatile of these shorter accustomed field movement and you will derivatives. Futures trading lets people so you can secure charges for merchandise, currencies, and you will monetary devices months if not years ahead of time, taking a life threatening tool to have handling speed risk and you will speculation. Hedgers have fun with futures deals to mitigate the possibility of price change supposed as well low when the time comes to enable them to promote an asset otherwise increasing an excessive amount of if they have to buy it later from the location field. This type of traders are makers, customers, or buyers which have experience of the root resource who utilize futures contracts so you can protect cost, effortlessly guaranteeing against price volatility.